Risk Based And Factor Investing. Factor investing is an investment approach that involves targeting specific drivers of return across asset classes. The long side of BAV is low volatility low risk and short high volatility while matching correlation similar. Factor investing is the investment process that aims to harvest these risk premia through exposure to factors. They demonstrated five unique risks that investors need to be cognizant of when investing in factors and why they could underperform the factors if they choose to ignore them.

We currently identify six equity risk premia factors. An investing system backed by the peer-reviewed gold standard of academic research and top money managers. Risk-based investing generally views a portfolio as a collection of. Factor investing is about understanding the sources of risk that underlie a particular portfolio and taking investment decisions directly at the factor level while risk-based portfolio construction techniques can be used to put together risk-factor portfolios. Factors that influence Risk Tolerance. It draws from the experiences of professional investors from the worlds richest man Warren Buffett to commodities speculator Richard Dennis who turned 1600 into 200 million within a decade.

Factors that influence Risk Tolerance.

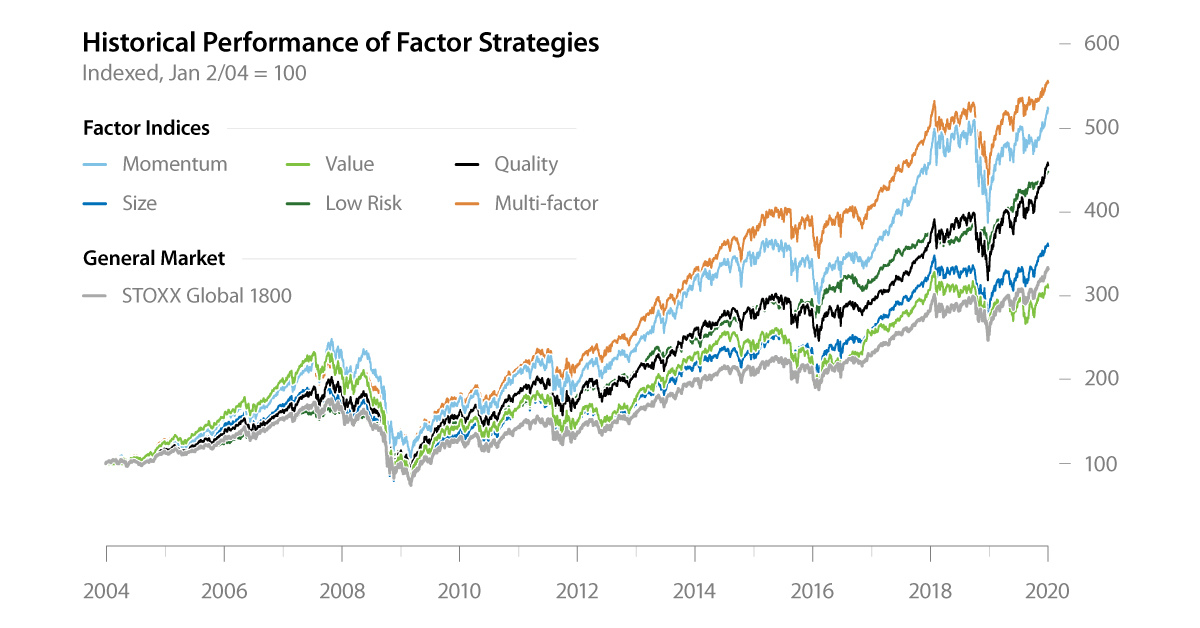

By focusing on the underlying factors that define risk return and correlation this approach seeks to explain why some asset classes move together and to offer more efficient portfolio construction. Value Low Size Low Volatility High Yield Quality and Momentum. Arnott Harvey Kalesnik and Linnainmaa provide investors with important information about factor-based investing. Remarkably Jurczenko manages to offer under a single cover some of the best reading from academics and practitioners leading the research and application of these investment techniques. It draws from the experiences of professional investors from the worlds richest man Warren Buffett to commodities speculator Richard Dennis who turned 1600 into 200 million within a decade. Smart beta market beta alternative risk premia.