How To Calculate Yield On Treasury Securities. The TBILLYIELD Function is categorized under Excel FINANCIAL functions. Coupon rate is the rate of interest paid based on the face value. Treasury Yield C FV - PP T FV PP2 where C coupon rate FV face value. In financial analysis TBILLYIELD can be useful in calculating the yield on a Treasury bill when we are given the start date end date and price.

Yield Curve The Treasury Yield Curve is the global benchmark for US. The specific Treasury securities used to construct. The curve is typically depicted as a graph with yields along the Y-axis and Maturities along the X-axis. The discount method relates the investors. Subtract 100 minus the ask price. The spread between 2-year US.

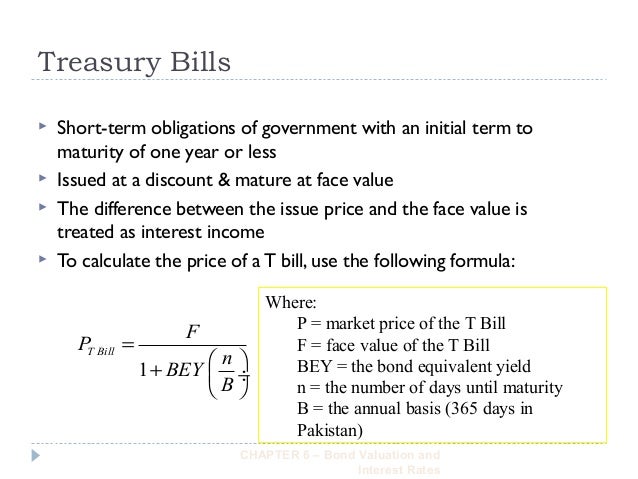

The face value of the security how much the security was purchased for and how long it.

So in other words the T-bill offers a return on investment of 124052 but since you held it for 91 days you will enjoy this return on a. 360 Number of days in a year as per banking conventions t Number of days until maturity. Treasury securities including Treasury bonds T-bonds depends on three factors. The curve is typically depicted as a graph with yields along the Y-axis and Maturities along the X-axis. The discount method. Treasury securities defines the slope of the yield curve which in this case is 256 basis points.