Five Factor Model Fama French. The model improves the Fama and French 3 factor model 1993 by adding two additional factors. Evidence since its publication emerged indicating that a companys investing behaviour and. Factor model uses movements in risk factors to explains portfolio returns. Implementation of 5-factor Fama French Model.

Instead of the Momentum factor it introduces the Profitability RMW and Investment CMA factors. The Fama-French 5 factor model was proposed in 2015 by Eugene Fama and Kenneth French. A five-factor model directed at capturing the size value profitability and investment patterns in average stock returns performs better than the three-factor model of Fama and French FF 1993. The Fama-French Five Factor Model. Description of FamaFrench 5 Factors 2x3 Monthly Returns. We also examine whether model failures are related to shared characteristics of problem portfolios identified in many of the sorts examined here in other.

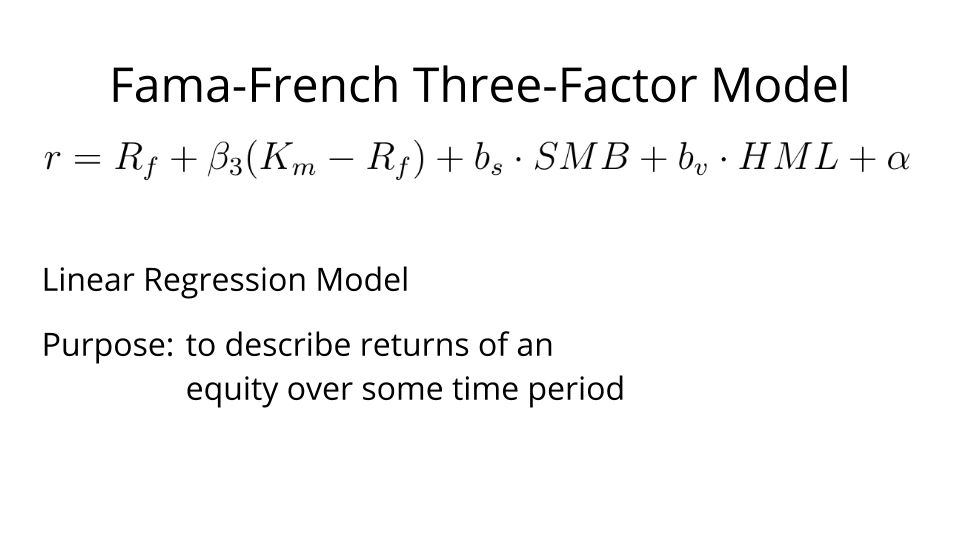

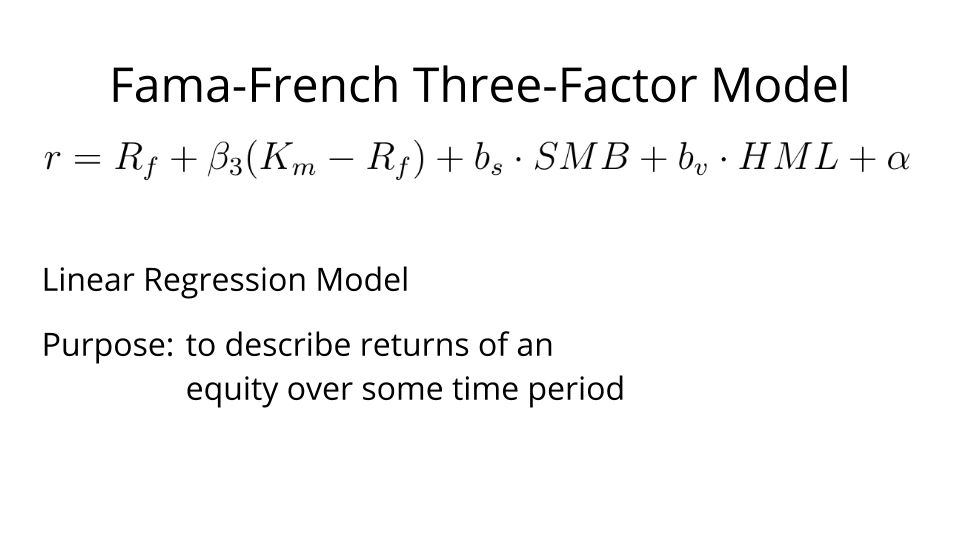

The Fama and French Three-Factor Model.

The Fama and French Three-Factor Model. Certain characteristic of economy InflationGDP or stock market itself SP 500 Factor Model. We move to more hostile territory in Fama and French where we study whether the five-factor model performs better than the three-factor model when used to explain average returns related to prominent anomalies not targeted by the model. Factor model uses movements in risk factors to explains portfolio returns. A five-factor model directed at capturing the size value profitability and investment patterns in average stock returns performs better than the three-factor model of Fama and French FF 1993. The five-factor models main problem is its failure to capture the low average returns on small stocks whose returns behave like those of firms that invest a lot despite low profitability.